Mutual fund expense ratio calculator

The Financial Industry Regulatory Authority FINRA Fund Analyzer offers information and analysis on over 18000 mutual funds exchange traded funds ETFs and exchange traded notes. Total Expense Ratio - TER.

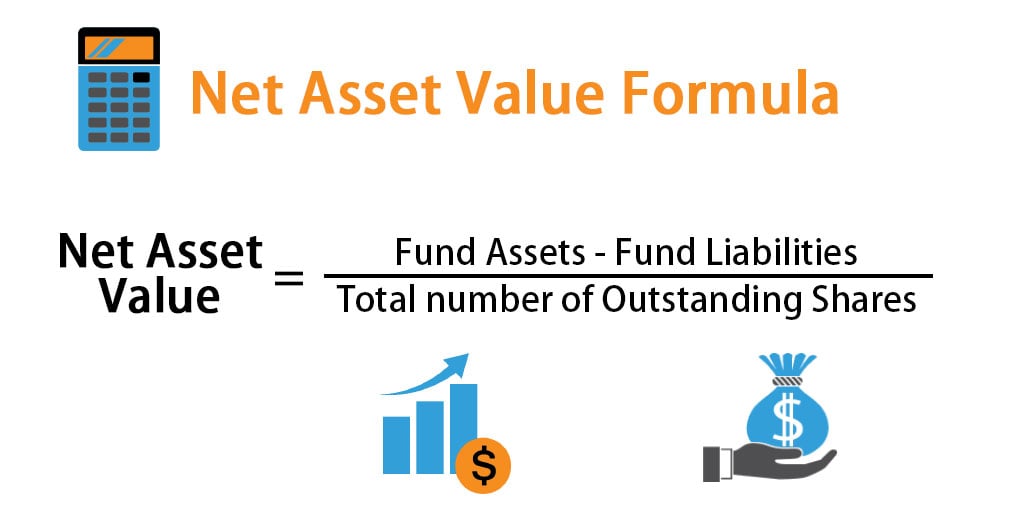

Net Asset Value Formula Calculator Examples With Excel Template

This mutual fund fees calculator can help analyze the costs associated with buying shares in a mutual fund.

. Mutual fund calculator helps you to calculate mutual fund returns on your investment. All mutual funds have expenses which can range from as low as 010 for an index. Expense Ratio of more than 15 is considered.

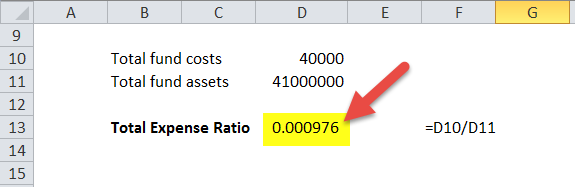

Know the capital gain the maturity amount of your mf investments. This calculator can help you analyze the costs associated with buying shares in a mutual fund. In real life that means if the fund spends 100000 a year on operating costs and has 10 million in.

By entering a few pieces of information found in the funds prospectus view the. If a mutual fund quotes an expense ratio of 1 then 1 of 110000 that is 1100 will be deducted and the value shown in the statement will be 108900. Mutual Fund Expense Calculator.

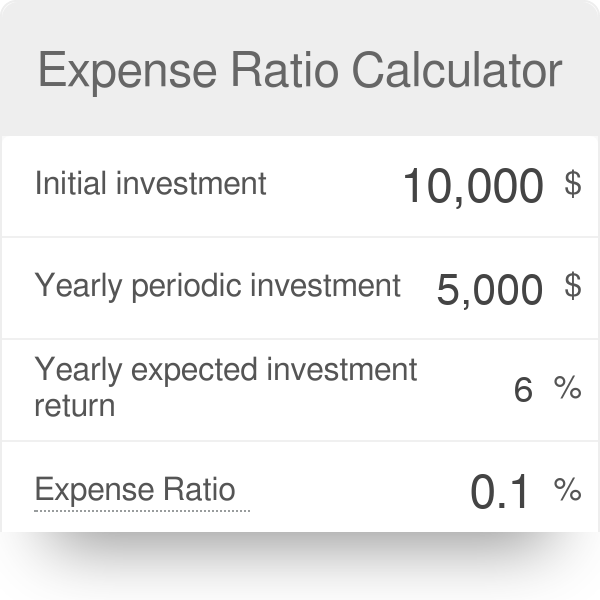

Heres a simple example I created on the calculator assuming the following. For example if the expense ratio of a fund is 1 it implies that the fund will. Index fund with expense ratio of 010 for reference Vanguards SP 500 ETF has expense ratio of.

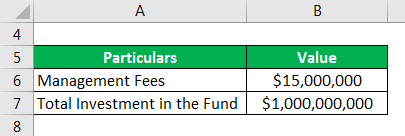

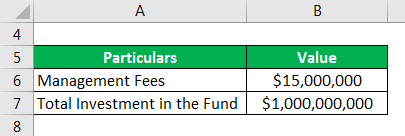

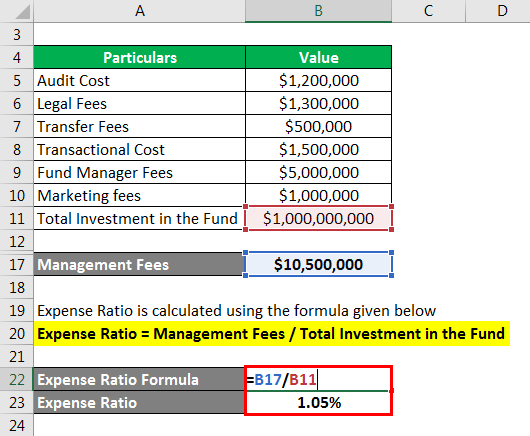

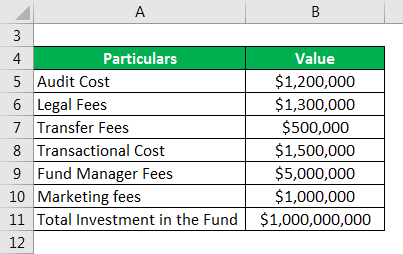

For instance lets assume that. The expense ratio of a fund is expressed in terms of the percentage of the total assets of the fund. Expense ratio Annual fund expenses Total assets under management.

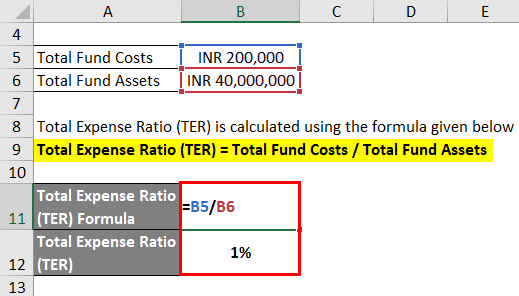

The formula for Expense Ratio. One of the few investment outcomes that is completely in your control is expenses. The total expense ratio TER is a measure of the total costs associated with managing and operating an investment fund such as a mutual fund.

The expense ratio is a measure of the total operating expenses for a mutual fund or ETF. 05 to 075 Expense Ratio for an actively managed portfolio is considered to be a good one and beneficial for the investors. An expense ratio reflects how much a mutual fund or an ETF exchange-traded fund pays for portfolio management administration marketing and distribution among other expenses.

The Operating Expense Ratio OER is calculated by dividing the annual fund operating expenses by the highest one-year total return of any portfolio he has ever published. By using the Cost Calculator investors will find answers quickly to questions like this. Its expressed as a percentage of the funds assets and its calculated by dividing the.

Which is better a no-load fund with yearly expenses of 175 or a fund with a front-end. By entering a few pieces of information found in your funds. By using the Cost Calculator investors will find answers quickly to questions like this.

Expense ratio Annual fund expenses Total assets under management. Expense Ratio Total costs that are borne by the mutual fund Average assets under management Total costs that are borne by the fund The costs.

Expense Ratio Formula Calculator Example With Excel Template

Expense Ratio Formula Calculator Example With Excel Template

Total Expense Ratio Formula Ter Calculator Excel Template

Mutual Fund Expense Ratio Calculator Impact Of Expense Ratio On Your Return Youtube

Create An Investment Fund Calculator With Microsoft Excel Youtube

Expense Ratio Formula Calculator Example With Excel Template

Expense Ratio Calculator For Etfs

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Total Expense Ratio Formula Ter Calculator With Excel Template

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Total Expense Ratio Formula Ter Calculator With Excel Template

Total Expense Ratio Formula Ter Calculator Excel Template

Pin On Articles To Read

Expense Ratio Formula Calculator Example With Excel Template

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest